Natural Gas weekly special report based on 1.00 Lot Calculation:

TECHNICAL ANALYSIS:

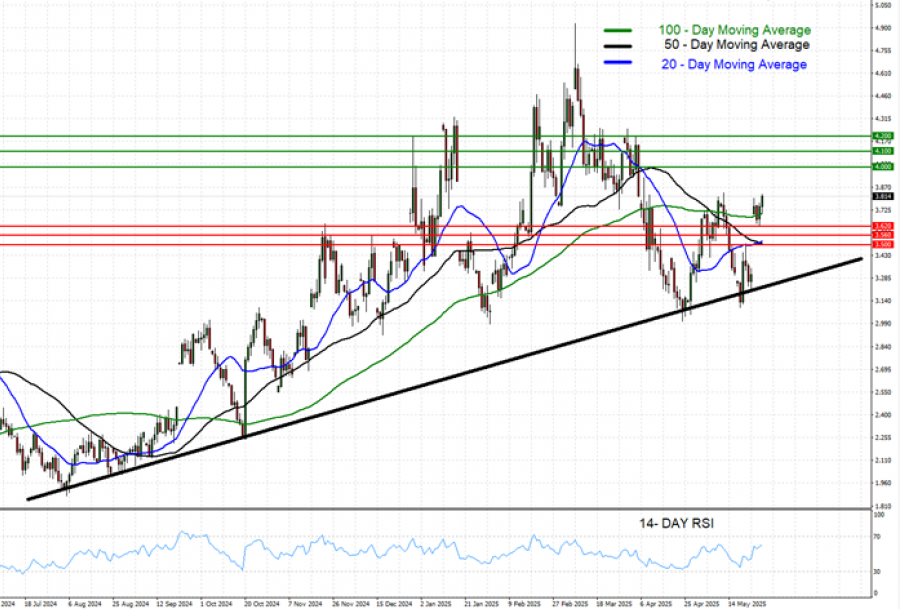

- SHORT-TERM SUPPORT AREA BELOW THE PSYCHOLOGICAL MARK OF $3.50: Natural Gas has maintained short-term support in the area below the level of $3.5, as shown by the daily chart below.

- DAILY MOVING AVERAGES POINT TO UPTREND: Natural Gas prices have recently traded above the 20-, 50-, and 100-Day Moving Averages, pointing to an ongoing uptrend. However, natural gas prices can also change their trend if prices fall below the 20-, 50-, and 100-Day Moving Averages.

- 14- DAY RELATIVE STRENGTH INDEX (RSI) STAYS ABOVE 50: The chart below shows that the 14- day relative strength index (RSI) remains in an uptrend, floating above the break-even point of 50, towards the upper limit of 70, before it tries to enter an oversold territory and potentially change its trend.

- LONGER-TERM TREND LINE: The black trend line depicted by the chart below shows that Natural Gas prices have maintained their uptrend in general since July 2024.

- RESISTANCE AND SUPPORT LEVELS: Natural gas has remained in a short-term uptrend, looking at Resistance 1 of $4.000, Resistance 2 of $4.100, and Resistance 3 of $4.200 to the upside. On the downside, Natural Gas looks at Support 1 of $3.6200, then towards Support 2 of $3.560 and Support 3 of $3.500.

GRAPH (Daily): July 2024 – May 2025

Please note that past performance does not guarantee future results

EVENTS (ECONOMIC CALENDAR):

- THURSDAY, MAY 29 AT 15:30 GMT+1: ENERGY INFORMATION ADMINISTRATION (EIA) NATURAL GAS INVENTORY DATA (USA). If data showed a declining inventory for the past week, then positive support for the natural gas price could be expected. However, the price could decline as well.

GEOPOLITICS:

- MIDDLE EAST TENSIONS HAVE RECENTLY RISEN AS NO CONCRETE DEALS HAVE BEEN MADE BETWEEN THE USA AND IRAN. A fifth round of talks took place in Rome on Friday (May 23). The latest (fifth) round of talks between the US and Iran has ended in Rome with no concrete agreements. Iran is still insisting on continuing its uranium enrichment program, while the USA wants zero uranium enrichment from Iran.

- RUSSIA-UKRAINE PEACE TALKS IN JEOPARDY. Uncertainties remain high even after President Trump- President Putin's phone call on May 19, as no breakthroughs have been announced. The phone call happened after a round of unsuccessful talks between Russia and Ukraine in Istanbul, Turkey, on May 16.

GLOBAL TRADE:

- BREAKING (MAY 12): U.S. AND CHINA ANNOUNCED A TARIFF RELIEF FOR 90 DAYS: U.S. and China have reduced tariffs, 145% to 30% (U.S.) and 125% to 10% (China). The deal could boost oil demand by easing trade and stimulating China’s economy, which is expected to drive higher usage of oil, supporting global prices.

- BREAKING (MAY 8): U.S. AND U.K. ANNOUNCED A TRADE DEAL ON THURSDAY, MAY 8. President Trump said this is the first of many to follow.

Natural Gas, May 28, 2025

Current Price: 3.800

|

Natural Gas |

Weekly |

|

Trend direction |

|

|

4.200 |

|

|

4.100 |

|

|

4.000 |

|

|

3.620 |

|

|

3.560 |

|

|

3.500 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

Natural Gas |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

4,000 |

3,000 |

2,000 |

-1,800 |

-2,400 |

-3,000 |

|

Profit or loss in €² |

3,533 |

2,650 |

1,767 |

-1,590 |

-2,120 |

-2,650 |

|

Profit or loss in £² |

2,966 |

2,224 |

1,483 |

-1,335 |

-1,779 |

-2,224 |

|

Profit or loss in C$² |

5,530 |

4,148 |

2,765 |

-2,489 |

-3,318 |

-4,148 |

- 1.00 lot is equivalent of 10,000 units

- Calculations for exchange rate used as of 12:46 (GMT+1) 28/05/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop techniques could protect the profit.