Platinum weekly special report based on 1.00 Lot Calculation:

TECHNICAL ANALYSIS:

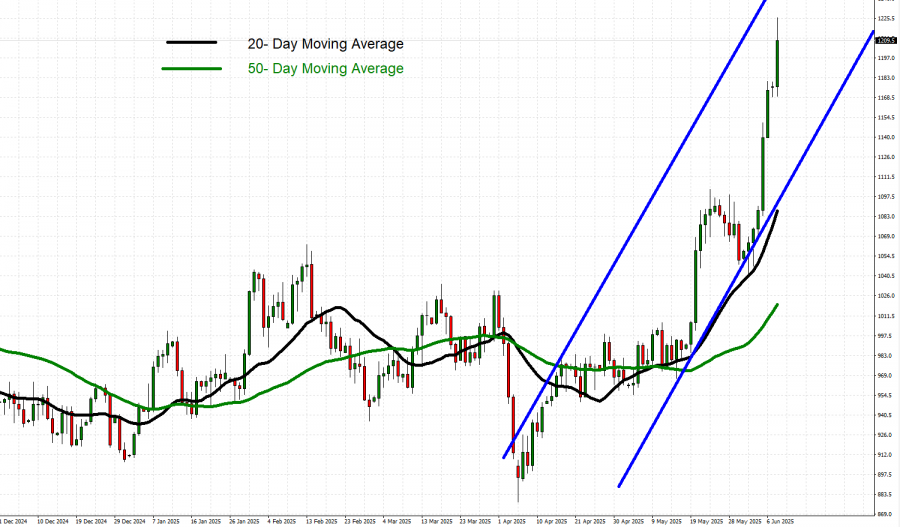

- UPTREND CHANNEL SINCE APRIL 2025: As depicted by the daily chart below, the platinum price has kept trading within the mid-term blue- lined uptrend channel, confirming its mid-term trend is up. The channel has been in place since April 2025.

- DAILY MOVING AVERAGES SIGNAL UPTREND: Platinum prices have moved above both the 20-day and 50-day moving averages, indicating a continued uptrend. However, this trend could reverse if prices drop below these key moving averages.

- RESISTANCE AND SUPPORT LEVELS: Platinum price has remained in a short-term uptrend, looking at Resistance 1 of $1,280 (May 2021 High), Resistance 2 of $1,320, and Resistance 3 of $1,347 (February 2021 High) to the upside. On the downside, Platinum looks at Support 1 of $1,130, then towards Support 2 of $1,120, and Support 3 of $1,100 (strong psychological support level).

- PLATINUM HIT AN ALL-TIME HIGH OF $2,300 (March 2008). Platinum price currently trades around $1,203, and if a full recovery takes place, then platinum prices could see an upside of 91%. However, Platinum prices could decline, too.

GRAPH (Daily): December 2024 – June 2025

Please note that past performance does not guarantee future results

US-CHINA TRADE TALKS:

- EVENT (MONDAY (June 9)): U.S.-CHINA TRADE TALKS BEGIN IN LONDON. Vice Premier He Lifeng is visiting the UK from June 9–13 and will chair the first meeting of the U.S.–China Economic and Trade Consultation Mechanism, according to China’s Foreign Ministry. President Trump confirmed that Treasury Secretary Scott Bessent, Commerce Secretary Howard Lutnick, and USTR Representative Jamieson Greer will meet with the Chinese delegation in London on June 9 to discuss a trade deal.

EVENTS (USA):

- WEDNESDAY, JUNE 11 AT 13:30 GMT+1: US INFLATION (CPI) (MAY): US Inflation has continued to fall in 2025 hitting 2.3% in April, which is the lowest rate since early 2021. If data continues to show firm declines in May, investors may increase their expectations for a Fed interest rate cut sooner than later. This, in turn, could put negative pressure on the US Dollar, while platinum prices could see some positive pressure.

- WEDNESDAY, JUNE 18 AT 19:00 GMT+1: US FEDERAL RESERVE INTEREST RATE DECISION. The Fed meets on June 18, as markets anticipate possible rate cuts amid slowing data. President Trump has intensified pressure, urging the Fed to ease policy, accusing it of stalling growth.

EVENTS (CHINA):

- MONDAY, JUNE 16 AT 03:00 GMT+1: CHINA INDUSTRIAL PRODUCTION (MAY): In April, China’s industrial production rose by 6.1%, exceeding expectations of a 5.7% increase. If China’s industrial production activity continues to expand, platinum price could some positive pressure, because that may improve the demand outlook from the largest consumer in the world, China.

Platinum, June 9, 2025

Current Price: 1,203

|

PLATINUM |

Weekly |

|

Trend direction |

|

|

1,347 |

|

|

1,320 |

|

|

1,280 |

|

|

1,130 |

|

|

1,120 |

|

|

1,100 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

PLATINUM |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

14,400 |

11,700 |

7,700 |

-7,300 |

-8,300 |

-10,300 |

|

Profit or loss in €² |

12,622 |

10,256 |

6,749 |

-6,399 |

-7,275 |

-9,029 |

|

Profit or loss in £² |

10,633 |

8,639 |

5,686 |

-5,390 |

-6,129 |

-7,605 |

|

Profit or loss in C$² |

19,702 |

16,008 |

10,535 |

-9,988 |

-11,356 |

-14,092 |

- 1.00 lot is equivalent of 100 units

- Calculations for exchange rate used as of 13:15 (GMT+1) 09/06/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop techniques could protect the profit.