PLATINUM Weekly Special Report based on 1 Lot Calculation:

TECHNICAL ANALYSIS:

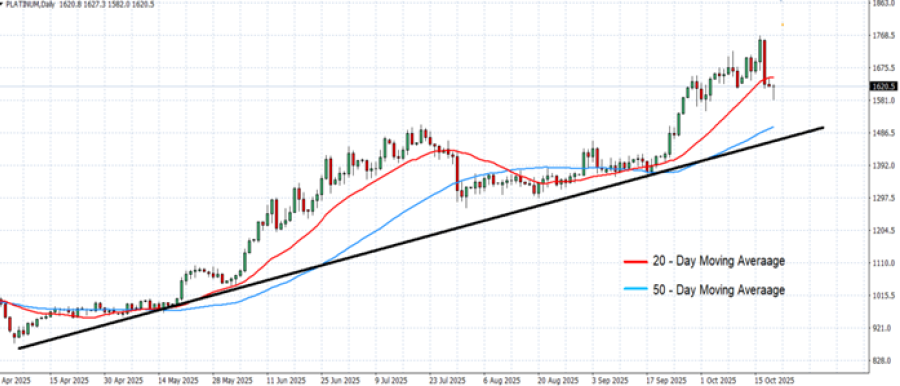

- DAILY MOVING AVERAGES (MA) CONFIRM UPTREND: The 20-day moving average (red) continues to slope upward, showing sustained short-term rising momentum. The 50-day moving average (blue) also trends higher and remains below the current price. Price action staying above both moving averages suggests sentiment remains positive.

- UPTREND STRUCTURE: The rising trendline (black) extending from April 2025 remains in place. As long as platinum holds above the 50-day MA and the trendline, the broader outlook remains positive.

- PRICE ACTION: Platinum price hit an all-time high of $2,300 (March 2018). Currently, platinum price is trading around $1,545 and if a full recovery follows the previous all-time high, platinum prices then could see an upside potential of 49%. Although, prices could decline, too.

GRAPH (Daily): April 2025 - November 2025

Please note that past performance does not guarantee future results

PLATINUM USE AND MARKET SHARE:

- PLATINUM has been a key element in auto catalysts for over forty years, especially for diesel engines, and is increasingly vital in hydrogen fuel cells. The automotive sector is its largest consumer, accounting for about 40% of annual demand.

- MARKET SHARE (PRODUCERS): BIGGEST PLATINUM PRODUCERS IN THE WORLD: South Africa is the largest producer, holding 72.8% of the global market share, while Russia is the second with 8-10% of the market. Zimbabwe is third with 5%.

- MARKET SHARE (CONSUMERS): China is the world's largest platinum consumer, with 34%, while Europe holds 22 and North America 16% of the platinum consumed worldwide.

TRADE: OPTIMISM PREVAILS

- US PRESIDENT TRUMP AND CHINA PRESIDENT XI AGREED ON A ONE-YEAR TRADE DEAL (OCTOBER 30): The agreement has improved overall trade sentiment between major economies, contributing to a more stable global outlook. As China remains the world’s largest consumer of platinum, any recovery in industrial activity and trade flows could be reflected in underlying demand trends for the metal.

EVENTS:

- WEDNESDAY, NOVEMBER 5 AT 13:15 GMT: US ADP NONFARM EMPLOYMENT CHANGE (OCTOBER). The ADP National Employment Report measures monthly changes in U.S. private-sector jobs and is unaffected by the government shutdown. Weaker data could signal a softer labor market and influence Fed policy expectations, while stronger results may have the opposite effect. (PREVIOUS: -32,000)

- FRIDAY, NOVEMBER 7 AT 03:00 GMT: CHINA TRADE BALANCE AND EXPORT/IMPORT DATA (OCTOBER). A stronger-than-expected trade surplus, particularly if driven by resilient industrial export and import figures, could reinforce expectations of steady Chinese platinum demand and support prices. Conversely, a weaker outcome could pressure prices lower. China remains the world’s largest platinum consumer, making this data especially significant.

- SUNDAY, NOVEMBER 9 AT 01:30 GMT: CHINA INFLATION (CPI) (OCTOBER): A rebound in consumer prices could indicate recovering domestic demand and stronger economic momentum, potentially boosting expectations for higher industrial palladium use. (PREVIOUS: -0.3%)

- FRIDAY, NOVEMBER 14 AT 02:00 GMT: CHINA INDUSTRIAL PRODUCTION (OCTOBER): A stronger-than-expected reading would confirm growth in China’s manufacturing and automotive sectors, likely supporting palladium prices through increased demand for catalytic converters and industrial applications. (PREVIOUS: +6.5%)

PLATINUM, November 4, 2025.

Current Price: 1,545

|

PLATINUM |

Weekly |

|

Trend direction |

|

|

1,800 |

|

|

1,700 |

|

|

1,630 |

|

|

1,470 |

|

|

1,440 |

|

|

1,400 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

PLATINUM |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

25,500 |

15,500 |

8,500 |

-7,500 |

-10,500 |

-14,500 |

|

Profit or loss in €² |

22,199 |

13,493 |

7,400 |

-6,529 |

-9,141 |

-12,623 |

|

Profit or loss in £² |

19,520 |

11,865 |

6,507 |

-5,741 |

-8,038 |

-11,100 |

|

Profit or loss in C$² |

35,897 |

21,820 |

11,966 |

-10,558 |

-14,781 |

-20,412 |

- 1.00 lot is equivalent of 100 units

- Calculations for exchange rate used as of 9:45 (GMT) 4/11/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop techniques could protect the profit.