PLATINUM Weekly Special Report based on 1 Lot Calculation:

PLATINUM USE AND MARKET SHARE:

- PLATINUM has been a key element in auto catalysts for over forty years, especially for diesel engines, and is increasingly vital in hydrogen fuel cells. The automotive sector is its largest consumer, accounting for about 40% of annual demand.

- MARKET SHARE (PRODUCERS): BIGGEST PLATINUM PRODUCERS IN THE WORLD: South Africa is the largest producer, holding 72.8% of the global market share, while Russia is the second with 8-10% of the market. Zimbabwe is third with 5%.

- MARKET SHARE (CONSUMERS): China is the world's largest platinum consumer, with 34%, while Europe holds 22%, and North America holds 16% of the platinum consumed worldwide.

PLATINUM MARKET: TIGHT SUPPLY AND STRUCTURAL DEMAND UNDERPIN 2026 OUTLOOK

- MARKET DEFICIT: PHYSICAL INVENTORY LEVELS BECAME EXTREMELY LOW GLOBALLY. By late December 2025, platinum inventories were reported to cover only about five months of global consumption, a historically tight level that puts upward pressure on pricing when buyers compete for metal. This depletion of inventory is explicitly cited as a key driver supporting rising platinum prices because it means there is very little buffer metal available for buyers. (Source: CME group)

- SUPPLY CONSTRAINTS: MINE OUTPUT REMAINS LIMITED BY SOUTH AFRICAN PRODUCTION RISK. World Platinum Investment Council (WPIC) data show that global platinum mine output remains concentrated in South Africa, where aging assets, power shortages, and labor uncertainty continue to suppress meaningful supply growth in 2026.

- INDUSTRIAL DEMAND: AUTOCATALYST SUBSTITUTION AND INDUSTRIAL USE SUPPORT VOLUMES. Platinum demand remains resilient, supported by ongoing substitution from palladium in automotive catalysts and sustained industrial consumption across chemicals, refining, and heavy industry, underpinning structural demand into 2026.

US FEDERAL RESERVE

- WEDNESDAY, JANUARY 28 AT 19:00 GMT: U.S. FEDERAL RESERVE INTEREST RATE DECISION. The Federal Reserve is expected to keep interest rates unchanged at 3.75%. Markets will focus on the Fed’s statement and guidance for clues on future policy. Any signals of a more supportive view toward growth or openness to further easing would likely pressure the U.S. dollar and support further increase in platinum prices.

- DECEMBER 10, 2025: U.S. FEDERAL RESERVE CUTS INTEREST RATES TO 3.75%. This is their third consecutive rate cut, following those on September 17 and October 29, 2025. It marks the lowest rate since September 2022.

EVENTS:

- SATURDAY, JANUARY 31 AT 01:30 GMT: MANUFACTURING PMI (JANUARY) IN CHINA. Manufacturing PMI provides an early indication each month of economic activities in the Chinese manufacturing sector. In December, this indicator increased from 49.2 to 50.1. China is the world's largest consumer of platinum.

TECHNICAL ANALYSIS:

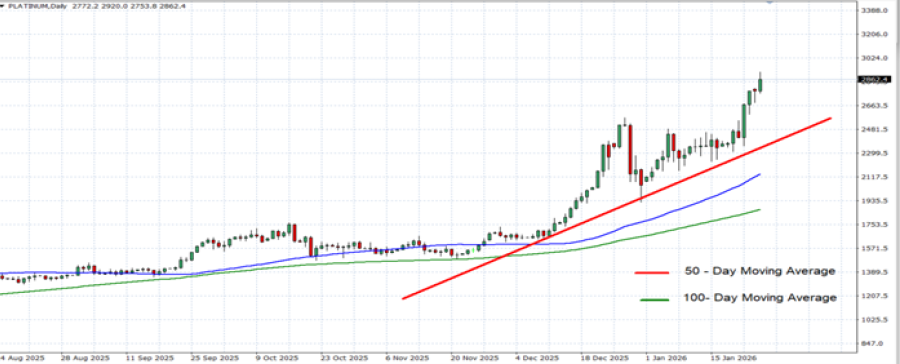

- DAILY MOVING AVERAGES CONFIRM STRONG UPTREND: Price continues to trade well above both the 50-day moving average (blue) and the 100-day moving average (green), confirming uptrend.

- UPTREND STRUCTURE REMAINS INTACT: Price action is firmly supported by the upward-sloping trendline (red), which has acted as a reliable dynamic support since late November 2025.

- PRICE ACTION: Platinum price hit an all-time high of $2,920 (January 26, 2025). Since the beginning of the month (January) the price has already increased by around 40%.

GRAPH (Daily): August 2025 - January 2026

Please note that past performance does not guarantee future results

Platinum, January 26, 2026

Current Price: 2,848

|

PLATINUM |

Weekly |

|

Trend direction |

|

|

3,600 |

|

|

3,400 |

|

|

3,200 |

|

|

2,500 |

|

|

2,450 |

|

|

2,400 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

PLATINUM |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

75,200 |

55,200 |

35,200 |

-34,800 |

-39,800 |

-44,800 |

|

Profit or loss in €² |

63,445 |

46,572 |

29,698 |

-29,360 |

-33,579 |

-37,797 |

|

Profit or loss in £² |

55,023 |

40,389 |

25,755 |

-25,463 |

-29,121 |

-32,779 |

|

Profit or loss in C$² |

102,895 |

75,529 |

48,163 |

-47,616 |

-54,458 |

-61,299 |

- 1.00 lot is equivalent of 100 units

- Calculations for exchange rate used as of 11:50 (GMT) 26/01/2026

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop techniques could protect the profit.