SILVER weekly special report based on 1.00 Lot Calculation:

GEOPOLITICS:

- EVENT (TUESDAY, SEPTEMBER 23 at 16:36 GMT+1): US PRESIDENT TRUMP TO SPEAK AND ADDRESS THE 80TH U.N. GENERAL ASSEMBLY (UNGA). Trump's upcoming appearance on September 23 will mark his fifth UNGA address and the first of his second term. Trump has addressed the UNGA multiple times during his first term as US President from 2017 to 2021 (Source: The Economic Times).

UNITED NATIONS GENERAL ASSEMBLY: The UN General Assembly (UNGA) is the main policy-making organ of the Organisation. Comprising all Member States, it provides a unique forum for multilateral discussion of the full spectrum of international issues covered by the Charter of the United Nations. Each of the 193 Member States of the United Nations has an equal vote (Source: The Economic Times).

TIMELINE:

- 2017: In 2017, Trump made his debut at UNGA, where he warned that the US might "totally destroy North Korea" if provoked and mocked North Korean leader Kim Jong-un as "Rocket Man." He also criticised Iran's leadership and described the Iran nuclear deal as an "embarrassment" at that time.

- 2018: In 2018, he highlighted his "America First" agenda, rejecting globalism.

- 2019: In 2019, Trump’s address focused on nationalism, tariffs on China, and warnings concerning Iran and immigration.

- 2020: During 2020, amid the COVID-19 pandemic, he delivered a brief pre-recorded statement blaming China for the virus's spread and highlighting Middle East peace agreements brokered under his administration.

EVENTS:

- THURSDAY, SEPTEMBER 25 AT 13:30 GMT+1: US GDP (Q2) third and last reading. According to the second reading, the US economy grew 3.3% in the second quarter. If the third reading printed below 3.3% GDP (Q2) growth, the US dollar could be then expected to come under negative pressure due to potential disappointments, supporting silver prices positively.

- THURSDAY, SEPTEMBER 25 AT 13:30 GMT+1: US WEEKLY INITIAL JOBLESS CLAIMS. This is a weekly report and it tells investors how many people have asked for unemployment assistance due to losing their job. If the number comes in higher than expected, it could renew worries regarding the US employment market, which in turn, could put negative pressure on the US dollar. In this case, silver prices could see some positive pressure.

- FRIDAY, SEPTEMBER 26 AT 13:30 GMT+1: US PERSONAL CONSUMPTION EXPENDITURE (PCE) (AUGUST). This inflation data is preferred by the US Federal Reserve when communicating consumer price changes and expectations. Therefore, if data shows that inflation remains stable and it does not rise above certain ranges, then investors could continue expecting more interest rate cuts by the Fed in 2025. This is expected to put negative pressure on the US dollar, supporting silver prices, on the other hand.

TECHNICAL ANALYSIS:

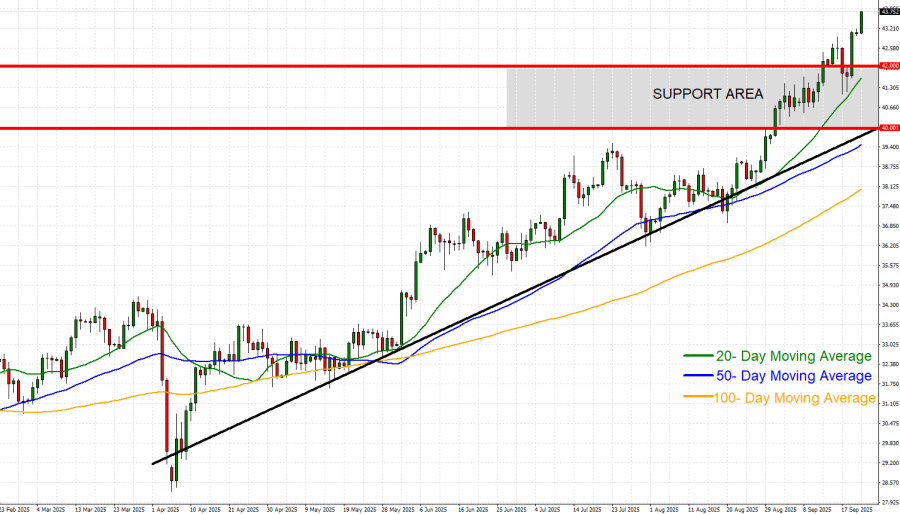

- PYSCHOLOGICAL SUPPORT AREA: $40 - $42. After hitting fresh 14-year highs ($43.715), silver prices have remained above the area defined by of $40 - $42, which has now become its next psychological support. Silver was last trading above $43.

- UPTREND SINCE APRIL 2025: After the March-April price pullback, silver prices have since been trading in uptrend, as depicted by the daily chart below and the solid black uptrend line on the same chart. Since the beginning of 2025, silver prices have risen by around 52%.

- ALL-TIME HIGH PRICE: $49.80. Silver jumped to $49.80 in 2011, during the debt crisis in Europe. Currently, silver trades around $43.60, and if a full recovery is made, this could offer an upside potential of around 14%. However, the price could decline.

- ANALYSTS’ OPINION: Deutsche Bank forecasts $45.

GRAPH (Daily): February 2025 – September 2025

Please note that past performance does not guarantee future results

Silver, September 22, 2025

Current Price: 43.60

|

Silver |

Weekly |

|

Trend direction |

|

|

49.80 |

|

|

47.00 |

|

|

45.00 |

|

|

42.30 |

|

|

42.00 |

|

|

41.70 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

SILVER |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

62,000 |

34,000 |

14,000 |

-13,000 |

-16,000 |

-19,000 |

|

Profit or loss in €2 |

52,688 |

28,893 |

11,897 |

-11,047 |

-13,597 |

-16,146 |

|

Profit or loss in £2 |

45,922 |

25,183 |

10,370 |

-9,629 |

-11,851 |

-14,073 |

|

Profit or loss in C$2 |

85,585 |

46,934 |

19,326 |

-17,945 |

-22,086 |

-26,228 |

- 1.00 lot is equivalent of 10,000 units

- Calculations for exchange rate used as of 10:15 (GMT+1) 22/9/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.