US STOCK MARKET

- STOCK MARKET TREND DEFINITION

BULL MARKET: DEFINITION. While bear markets signal a time of pessimism and economic decline, a bull market is defined by optimism and economic growth. A bull market is a period when stock prices are rising and investor sentiment is positive. During a bull market, stocks in a broad market index increase in value by 20% or more from recent bottom. According to First Trust, the average bull market period lasted 6.6 years with an average cumulative total return of 339%.

BEAR MARKET: DEFINITION. According to Forbes, economists define a bear market as a decline of 20% or more of a major stock market index, such as the NASDAQ 100 or the S&P 500, for a sustained period. SENTIMENT: During a bear market, market sentiment is poor. Investors are pessimistic about the stock market’s prospects, making them more likely to sell assets than hold them.

Table I: Bear and Bull Market Characteristics

Data Source: Forbes

Please note that past performance does not guarantee future results

- MOST RECENT BULL MARKETS

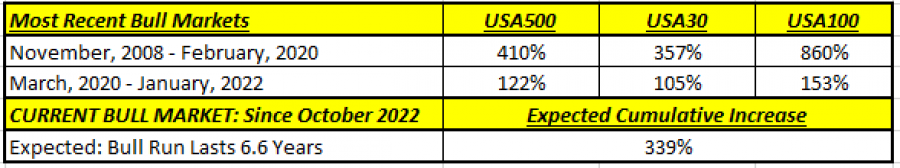

The table below shows the after the Gobal Financial Crisis, the bull market that took place in the USA pushed the USA100, USA500 and USA30 by 860%, 410% and 357%, respectively, in the period between November 2008 and February 2020. The next bull market took place between March 2020 and January 2022, pushing the USA100, USA500 and USA30 up by 153%, 122% and 105%, respectiverly. The last raw of the table shows what is the average (expected) time frame for one bull market based on anlaysis sourced by First Trust (6.6 years). During that period the the US stock indices on average rise by 339%.

Table II: Most Recent Bull Markets

Data Source I: MetaTrader; Data Source II: First Trust

Please note that past performance does not guarantee future results

A NEW ERA OF ARTIFICIAL INTELLIGENCE LOOKS LIKE THE DOT COM ERA IN THE LATE 90’s

- DOT COM (INTERNET ERA) (STARTING A FRESH NEW BULL MARKET)

HISTORY:

ERA: Dot Com

Period: 1995- 2000

MEANING: The dotcom bubble was a rapid rise in U.S. technology stock equity valuations fueled by investments in Internet-based companies during the bull market in the late 1990s.

Source: Investopedia

NASDAQ 100 (USA100): UP more than 400% from 1995 to 2000.

INDIVIDUAL STOCKS: Notable Individual Stock Increase (1995- 2000):

- MICROSOFT UP around 1300%

- AMAZON UP around 2500%

Data Source: Bloomberg

Please note that past performance does not guarantee future results

- ARTIFICIAL INTELLIGENCE (AI) (STARTING A FRESH NEW BULL MARKET)

HISTORY:

ERA: Artificial Intelligence (AI)

Period: October 2022- Present

MEANING: Artificial intelligence is the simulation of human intelligence processes by machines, especially computer systems. Specific applications of AI include expert systems, natural language processing, speech recognition and machine vision. AI is important for its potential to change how we live, work and play. It has been effectively used in business to automate tasks done by humans, including customer service work, lead generation, fraud detection and quality control. In a number of areas, AI can perform tasks much better than humans.

Source: TechTarget

NASDAQ 100 (USA100): The index has risen around 83.6% from October 9, 2022 to present day (June 12, 2024).

INDIVIDUAL STOCKS: Individual Stock Increase (October 9, 2022- Present Day (June 12, 2024))

- NVIDIA UP around 1016%

- AMD UP around 191%

- MICROSOFT UP around 98%

- META (FACEBOOK) UP around 313%

Data Source: Bloomberg

Please note that past performance does not guarantee future results

WEEKLY CHARTS (OCTOBER 2022 – JUNE 2024): USA100, USA500, USA30

- USA100

Source: MetaTrader 4 Platform

- USA500

Source: MetaTrader 4 Platform

- USA30

Source: MetaTrader 4 Platform