Wheat Weekly Special Report based on 1.00 Lot Calculation:

GLOBAL WHEAT MARKET SHARE:

- LARGEST WHEAT PRODUCERS (OF TOTAL PRODUCTION EXPECTED IN 2024/2025: 793.24 MILLION TONES): China at 17%, India at ~14%, Russia at ~10%, USA at ~6%, and Ukraine at ~3%.

- LARGEST WHEAT EXPORTERS OF A TOTAL 212.31 MILLION TONS (2024/2025): Russia at around 20%, the European Union at 14.13%, Canada at 12.25%, Australia at 11.78%, the USA at 10.58%, and Ukraine at 7.54%.

- RUSSIA + UKRAINE SHARE at ~30%: Russia and Ukraine account for nearly one-third of total global exports.

CURRENT GEOPOLITICAL OUTLOOK:

- ESCALATING TENSIONS BETWEEN RUSSIA AND NATO INCREASE FEARS OF DISRUPTIONS IN GRAIN SUPPLIES. Germany has deployed its warships Hamburg to the Baltic Sea, aiming to secure critical area after a surge in Russian drone activity near NATO territory. At the same time, Russia’s drones have violated the airspace of Poland, Estonia, and Romania, prompting strong warnings from U.S. President Donald Trump that Washington would defend NATO allies under Article 5. These developments highlight the rising risk of a direct confrontation between Russia and NATO, which could destabilize grain flows from the Black Sea region, one of the world’s most important wheat export hubs. With supply security once again under threat from geopolitical instability, the outlook remains supportive for higher wheat prices.

ONGOING SUPPLY DISRUPTIONS: With no resolution, Ukrainian wheat exports remain limited, supporting elevated risk premiums and supply concerns in global wheat markets.

RUSSIAN WHEAT PRODUCTION: Russia produces around 10% of total wheat production in the world, making it the 3rd largest wheat producer in the world after China and India.

RUSSIAN WHEAT EXPORTS: Russia is the largest wheat exporter in the world, responsible for around 20% of total global exports in the world.

IMPACT OF THE RUSSIA-UKRAINE WAR:

The Russia-Ukraine war has significantly disrupted the global wheat market, as both countries together account for over 30% of global wheat exports. Key effects include:

- SUPPLY DISRUPTIONS: RUSSIAN WHEAT EXPORTS DROP SHARPLY, ADDING TO GLOBAL SUPPLY WORRIES. Russia’s wheat exports in July–September 2025 fell by 29% year-on-year to just 10.9 million tons, forcing a downward revision in its annual export forecast to 43.4 million tons, according to UNN (Ukraine National News) with reference to the Foreign Intelligence Service. As Russia is the world’s largest wheat exporter, such a significant decline in shipments tightens global supply and heightens concerns about availability in key importing regions, which supports outlook for higher wheat prices.

- PRICE VOLATILITY: Wheat prices surged to record highs in 2022, due to concerns over supply shortages. Food inflation increased globally, particularly in wheat-dependent countries in Africa and the Middle East.

- TRADE ROUTE BLOCKADES: The closure of Black Sea ports forced Ukraine to rely on alternative, less efficient land routes, further increasing costs and logistical challenges.

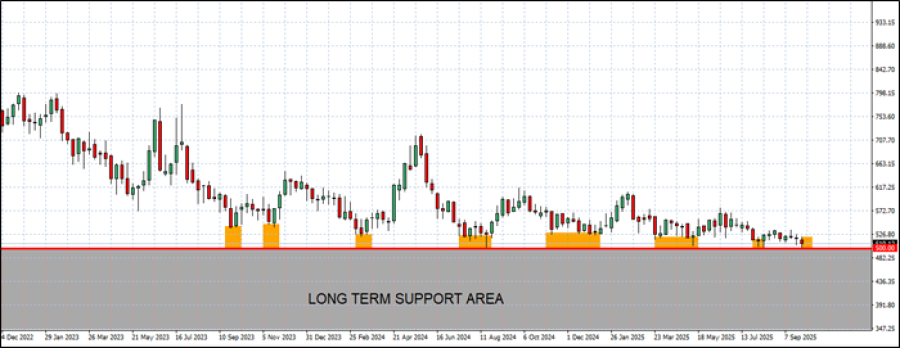

TECHNICAL ANALYSIS:

- STRONG SUPPORT AT $500 OR NEAR: Since September 2023, Wheat has tested the area around $500 seven times, and every time it wheat prices would recover. This is the 8th time in the past around two years that wheat prices have tested levels near $500. (Source: Fortrade Meta Trader 4 Platform).

GRAPH (Weekly): December 2022 – October 2025

Please note that past performance does not guarantee future results.

WHEAT, October 2, 2025.

Current Price: 510

|

Wheat |

Weekly |

|

Trend direction |

|

|

570 |

|

|

550 |

|

|

535 |

|

|

490 |

|

|

480 |

|

|

470 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

WHEAT |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

6,000 |

4,000 |

2,500 |

-2,000 |

-3,000 |

-4,000 |

|

Profit or loss in €2 |

5,105 |

3,403 |

2,127 |

-1,702 |

-2,552 |

-3,403 |

|

Profit or loss in £2 |

4,443 |

2,962 |

1,851 |

-1,481 |

-2,222 |

-2,962 |

|

Profit or loss in C$2 |

8,362 |

5,575 |

3,484 |

-2,787 |

-4,181 |

-5,575 |

- 1.00 lot is equivalent of 100 units

- Calculations for exchange rate used as of 9:50 (GMT+1) 2/10/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.